This is the best office we have had," he lets on. As you enter the three-storied building in Domlur, a suburb in Bangalore, you're tempted to wonder whether K Ganesh, one half of India's most successful serial entrepreneur couple, is pulling a fast one — a narrow staircase, a cramped reception, and a virtually bare cabin small enough to remind you about those 'yo mama' jokes (yo mama's house is so small she eats her meals off a dime) rather than the cool start-up offices you're accustomed to reading about (casual seating, snack-filled kitchens, gaming spaces, graffiti-ed walls et al).

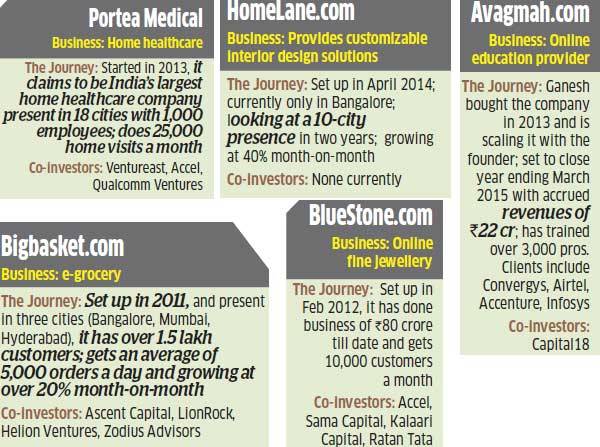

It's only a board pinned casually on the wall that assures you that you're in the right place; at what is clearly the right time for the 52-year-old Ganesh, and his 51-year-old wife Meena: It reads: 'Portea, Homelane, Bigbasket, Bluestone, Avagmah'.

That, in a line, sums up the uniqueness of the Ganeshes' entrepreneurial journey: five scorching start-ups in various stages of growth that the husband-wife duo are nurturing — as passionately and obsessively as they had reared four other ventures since the early '90s that they have now exited, and made a cool stash in the process (see The Exits).

The last exit was easily the biggest, when in 2011 Pearson acquired TutorVista, which the Ganeshes set up in 2006 with an investment of Rs 50 lakh. Pearson acquired the online tutoring firm for Rs 1,000 crore. Even as they stoke the growth fires at their five startups that are currently in play, another five are in stealth mode; at least three of those are set for a launch before the year-end. One of them is a start-up called Freshgrub, which will supply meals and ready-to-eat foods to homes and offices.

Angel Investors, Too

That's a lot on their plate, right? But that's not all. Alongside, the Ganeshes also find time to play angel investor in at least 23 start-ups, at last count. These range from Little Eye Labs, which builds performance analysis and monitoring tools, and which was acquired by Facebook; to OnlinePrasad. com, which home-delivers prasad from some 50 temples.

Say hello to the couple that has its hands full investing, strategizing, managing, mentoring — and, of course, exiting when the iron is hot. Executives in the venture capital and private equity industry peg the success rate of the start-ups the Ganeshes have been involved in at an astounding 100%; the global start-up success rate in contrast is just 5%. Small wonder then the Ganeshes have a few of India's biggest and most respected industrialists buying into their ventures.

Consider one of them: in the July of 2014, the chairman emeritus of one of the India's biggest conglomerates met the CEO of Blue-Stone.com, an online fine jewellery portal that the Ganeshes flagged off in 2012. "We met him. He got very interested. He liked BlueStone's business model — a one-stop shop for jewellery design, manufacturing and retailing which helps it cut middle men and offer better business margins," says Blue-Stone CEO Gaurav Singh Kushwaha.

After another meeting, the 76-year-old industrialist agreed to become co-investor along with private equity firms like Accel Partners, Sama Capital and Kalaari Capital. Oh, and in case you haven't guessed by now who this investor is, it's a certain Ratan Naval Tata.

Along with investors, the Ganeshes also have their fans amongst the doyens of India Inc. Take, for instance, Shiv Nadar, founder of HCL, with whom Ganesh worked in the early days of his career, in the mid to late '80s.

"I believe that a successful entrepreneur is one who is able to make the most of a particular environment — identify opportunities and create solutions. Ganesh's sharp knack to connect the dots allows him to create something new and relevant all the time," explains the chairman of HCL and the Shiv Nadar Foundation.

What particularly sets him apart is his ability to constantly accept feedback — to assess, reassess and introspect continuously and remain positive, he adds. "Both he and Meena are very quick thinkers too."

Midas Touch

Some of those qualities were in ample evidence when, last August, the Ganeshes launched a home healthcare services company called Portea Medical. Today, that company has a workforce of over 1,000, a presence in 18 cities and makes over 25,000 home visits a month. That's impressive enough for three investors — Ventureast, Accel and Qualcomm Ventures — to come aboard.

"The way they planned Portea and scaled it up so quickly is impressive," says Infosys co-founder Nandan Nilekani. "What is also impressive is that they enter a new field, put together a team and inevitably become successful in whichever area they get into," he adds.

There's a bit of serendipity around the Nilekani-Ganesh relationship. In October, 2007 The New York Times did a story on the globalization of consumer services, in which offshore tutoring, and therefore TutorVista.com, was talked about. Nilekani, then co-chairman of Infosys, talked about the opportunity for such services in the article. Ganesh promptly called up Nilekani after the piece was published and invited him over to their facility, which the latter accepted.

Two years later, out of the blue Nilekani called Ganesh to inform him that Khozem Merchant, president of Pearson India, wanted to meet him. Soon after the meeting, one thing led to another with Pearson first acquiring a stake in TutorVista and eventually buying it lock, stock and tutors in 2011.

"One of the important things they do well is to spot opportunities, grab them and get their hands dirty to make them successful, especially if they are IT-enabled businesses. They are extremely hard working," says Ranjan Pai, CEO and MD of Manipal Education & Medical Group.

As an investor in TutorVista, Pai recollects Ganesh being a tough negotiator who wouldn't take no for an answer. But clearly he also listens. "I remember telling him that I will invest in TutorVista only if Meena comes on board as I had heard so much about her execution capabilities," says Pai. "Meena duly came in as CEO and I had no choice but to invest," he grins.

Pai, who got a return of 3x for his investment in TutorVista, says the Ganeshes are an investor's delight: "They are straightforward, don't take shortcuts, there's no question of side deals, and you can trust them 100%."

Investors point out that the backing of Ganesh as a promoter often gets their start-up better valuations and investments much earlier in its lifecycle. "What stands out is his ability to constantly raise capital," says Prakash Prashanth, founder of Accel Partners.

The Strengths and Weaknesses

The TutorVista deal was a kind of comingof-age for Ganesh and Meena as entrepreneurs. Until then, they were mostly happy seeding and scaling one start-up at a time and giving it undivided attention. Ganesh recalls: "After the Pearson deal in 2011, we were doing the full ocean search. What should we do in the next 10-15 years?"

They thought about many things. Another start-up? Or was it time to just hang up their start-up boots and lead a relaxed, retired life? "We both were nearing 50. We finally decided on creating an entrepreneurship platform called GrowthStory.in," he says.

The idea was that the duo would identify business opportunities, put together a business plan, create a core team, chip in with the initial capital, test the concept with pilots and then take it to venture capitalists for funding. "We are seeking excitement and happiness in doing things that money can never buy," says Meena.

"My core strength is to marry technology with digital marketing with kolavery [murderous] scaling. I also know what I am not. I am not smart enough to do a WhatsApp, a Snapchat or a Facebook. I don't understand that space," says Ganesh.

There are a few filters they use to vet a potential business. An India focus is important. The business must be disruptive, the opportunity it offers must be big and scaleable over the next 10-15 years. Ideally, the business must solve a problem or a pain point, for which Indians don't mind paying. Also, these must be really tough businesses where more people expect them to fail than to succeed. "All this gives me a long rope and breathing space. It allows me to make mistakes. With little competition, it also gives us a disproportionate valuation for the business," adds Ganesh Portea is a good example of the kind of businesses the Ganeshes pursue.

With India's elderly population at 144 million and in a country where 51% of deaths are due to chronic illness, the opportunity that home healthcare services offers is huge. One estimate is that about 70% of hospital visits can be cut by delivering the services directly at home. "He spent over a year looking at the market, meeting people, understanding the businesses of others in the medical services space," recalls KP Balaraj, co-founder of WestBridge Capital.

Portea relies on pure online marketing and that's something the Ganeshes are pretty clear about: customer acquisition for most of its start-ups should be largely digital with small and sharply targeted campaigns.

Resource Sharing

A common entrepreneurship platform allows Ganesh to have a common pool of experts across all start-ups for functions like finance and marketing. For example, V Sundararajan, head of Numinous Consulting and a finance veteran with over three decades of experience with companies such as Wipro and Ashok Leyland, assists Ganesh in all critical financial decisions.

Similarly, the marketing function is being steered by Imran Khan, a Silicon Valley veteran who has done stints with companies such as Symantec and E-Loan and is also co-founder of Play-i, a company that makes robots to help children learn programming and creative problem-solving. The US-based Khan is the chief marketing officer of GrowthStory and heads a 20-member team which is based out of India. He plays a critical role in building online customer traction for all of their start-ups.

The Talent Strategy

The biggest problem that start-ups face is attracting and retaining top talent. It is here that the Ganesh-Meena duo's ability to attract and staff their start-ups stands out. How do they manage it?

There are a few thumb rules they follow. One, almost all their businesses are headed by people who they know well and have worked with in the past. For example, Karthik KS, CEO and cofounder of Avagmah, an online education start-up, worked with Ganesh at HCL in the '80s. Ganesh has also known Hari Menon, co-founder of Bigbasket.com, since the early 2000s when he set up his first dotcom venture Fabmall. com. "He gave me my first taste of a consumer business," says Ganesh. Similarly, Srikanth Iyer of Homelane.com was COO and later CEO at TutorVista. "Our core team always comprises people we know well. It helps us fast track without initial glitches," says Meena.

Of course, they can't rely only on the familiar. So when hiring 'outsiders', Meena says she looks for people who demonstrate, besides passion for the task, a tolerance for ambiguity, comfort amidst the unknown, and a penchant to challenge and ask questions. Of course, not all hires work out and in cases where they don't, action is swift. "Don't let it linger, that's best for the company and the executive," says Meena.

Ganesh has learnt from his TutorVista days that backing the right team is what makes the difference, according to Ronnie Screwvala, founder of Unilazer Ventures, an investor in consumer and media businesses. Unilazer and the Ganeshes are two out of four co-investors in Oximity.com, a start-up that crowdsources news and delivers it. "His ability to identify the right team, empower it and mentor it has been his formulae for continued success," adds Screwvala. "They [Ganeshes] do a great job of getting teams together. This I have seen as recurring trend," avers Pai.

Globally, particularly in Silicon Valley, serial entrepreneurs — from Netscape founder Marc Andreessen to Elon Reeve Musk — are not uncommon. In India there is somebody like Rajan Ananadan who angel-invests in tech start-ups in his personal capacity. The difference, though, is that he is hands off; his fulltime job is as Google India chief. "In that way the Ganeshes are unique," says WestBridge's Balaraj.

So how does the couple divvy up working with so many start-ups? "Broadly, he handles the external world [of start-ups], I the internal. Over time we have fallen into these roles," says Meena. Ganesh focuses on the big picture — strategy, exploring new businesses, networking with investors and the industry, and fund-raising. Meena is more the hands-on person looking at how to put together the team, thrashing out operational glitches, scaling-up woes and the like. "They bring very complementary skills. I have never seen a couple like this," gushes Pai.

They utilize their time well. All their start-ups are located within 1 km of the GrowthStory office. While they hire a CEO for each business, Ganesh and Meena take board seats in these companies. So a typical day of Ganesh involves working out of Portea's office between 9 am and 3 pm; after a short siesta, he's on his second shift from 5 pm during which he schedules calls with his start-up executives, investors or other entrepreneurs seeking advice.

He works till 8 pm and hits the sack by 10.30 pm. As an angel investor Ganesh gets up to 100 proposals a month. Typically, he looks at investments between Rs 5 lakh and Rs 50 lakh, Rs 25 lakh being the sweet spot. The investment decision — taken within two to four weeks — is usually based on the couple's assessment of the founder and the business he is in. Ganesh meets the founders of these start-ups three to four times a year. And he averages four to six angel investments in a year. Ganesh also mentors entrepreneurs on a one-off basis — roughly two a week.

The Monte Carlo Fallacy

If there's a worry for the Ganeshes, it's about the gambler's fallacy (the mistaken belief that a good run will eventually peter out) catching up with them on their fast-paced start-up journey. "So far their success rate has been very good. In fact it has been exceptional. I am not sure how long it will last," says Neeraj Bhargava, founder and CEO of Zodius Advisors. He, for one, would like to see the Meena-Ganesh duo build a $1-billion company.

Ganesh, for his part, says what scares him is their high success rate vis-a-vis the global norm. "But what is scarier is slow death rather than instant death," he adds. Meena points out that what worries her is the ability to create benefits for all stakeholders — investors, employers, customers — rather than just one of them. Such fears are unlikely to slow down this couple, which wants to keep the start-up factory going till they're 75. They well might be keen to keep at it after that — after all, who's heard of anybody retiring from a start-up!