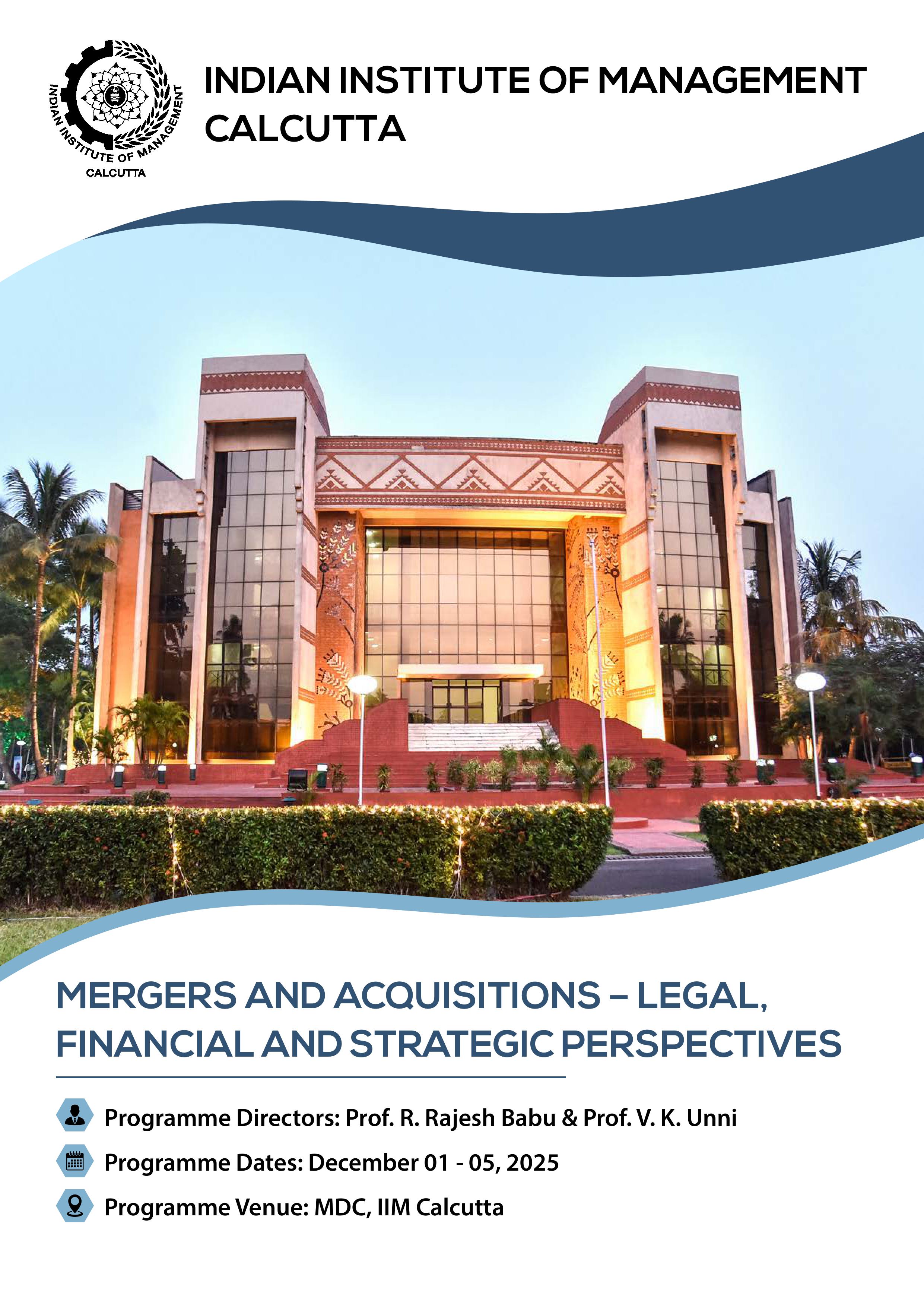

Programme Overview

Conducting business in the 21st century demands a completely new approach because of the challenges faced as a result of various by global uncertainties, increasing competition, massive technology disruption and complex legal and financial risks. In order to stay relevant, organisations are continuously reinventing themselves and competing on various parameters. On many occasions corporate restructuring through Mergers and Acquisitions (M&As) play a lead role to attain this objective and the last decade had witnessed the emergence of India as a prominent destination in the M&A sphere.

This programme shall cover various nuances corporate restructuring in general and M&A in particular from the legal, financial and strategic angle. It will also provide critical insights with respect to valuation, deal structuring, tax and regulatory framework along with case studies and group discussions.

Target Audience: Senior Executives, Managers, Legal Professionals, Financial Analysts, and Investors interested in M&A.

Format: Lectures, Case Studies, Group Discussions, Practical Workshops, and Guest Speakers.

Programme Objective

- Corporate Restructuring – Legal, Financial and Strategic Considerations

- Restructuring through Asset buy-outs/sell outs objectives and valuation methods in asset restructuring, slump sale

- Restructuring involving equity – objectives and role of NCLT, Merger process, Scheme of Arrangement, Competition law issues

- Tax considerations involved in corporate restructuring

- M&A from a strategic perspective -motivations for mergers and acquisitions from perspectives of different stakeholders

- M&A from a financial perspective - Valuation methods and their importance in the successful execution of M&A

- Legal and regulatory issues in acquisitions of listed entities -Takeover Code

- Case Studies and Group discussions

- Important case studies- Merger of HDFC Ltd with HDFC Bank Ltd. Demerger of FMCG business of Tata Chemicals, takeover of Mindtree by L&T

Key Topics

- Understanding the M&A lifecycle from strategy to integration.

- Gaining insights into Indian regulatory and legal nuances.

- Practical knowledge of financing, valuation, and structuring M&As.

- Real-world lessons from successful and failed M&As in India.

This 5-day program offers a balanced approach, combining theory with practical insights to ensure participants gain a deep understanding of the M&A process, particularly within the Indian market context.

Programme Directors

Programme Duration and Delivery

- From the morning of December 01, 2025 till the afternoon of December 05, 2025

- Face to face - classroom based

How to Apply

- You can apply/nominate your personnel by clicking on the “Apply Now” link corresponding to the particular MDP, as appearing on our online calendar available at: https://iimcal.ac.in/mdp/mdp-calendar

- Once the candidature(s) is (are) approved, the sponsoring authority or participant (in case of self-nomination) will be intimated over email along with a Proforma Invoice seeking programme fees in advance.

- Programme fees can be remitted online through Electronic Fund Transfer (NEFT/RTGS).

- Upon remitting the fees online, kindly intimate Executive Education Office with the UTRNo. /relevant transaction details through email, so that we can connect your remittance to your nomination(s). Please note that confirmation of participation is subject to receipt of Programme fees by CMDP Office before commencement of the MDP.

For further assistance, please connect with:

Name: Ms. Payel Majumder

Number: +91 33 7121 6012

Email ID: program_mdp[at]iimcal[dot]ac[dot]in