Programme Overview and Objective

With FinTech and Artificial Intelligence (AI) transforming the financial services industry, professionals must now combine core financial expertise with technological fluency. The Executive Programme in FinTech and AI from IIM Calcutta is designed to equip professionals with an integrated understanding of finance, technology, analytics, and innovation strategies. Covering everything from blockchain and ML to digital payments and regulatory tech, this programme empowers participants to lead financial transformation and innovation in their organizations.

Programme Directors

Who Should Attend

Early-career professionals in finance and bankingLooking to understand FinTech applications, innovations in lending, payments, and digital assets.

Mid-level professionals in technology, analytics, or consultingWho want to enter the FinTech space by understanding how financial systems and AI technologies converge.

Entrepreneurs and professionals from startups or financial institutionsSeeking to leverage FinTech, AI, and data analytics to build and scale disruptive business models

Eligibility

Minimum qualification required: Graduation (10+2+3)

Pedagogy

The programme is delivered asynchronously using a blend of pedagogical methods including interactive lectures, real-world case studies, marketing simulations, and hands-on projects. Sessions are primarily conducted online, complemented by an optional on-campus networking session. Participants engage with structured content at their own pace, supported by regular check-ins and assessments to reinforce application-based learning.

Programme Content

|

Pillar |

Module |

Sub-topics |

|---|---|---|

|

Introduction and overview |

Introduction to Banking, Financial Services and FinTech |

Global Finance Ecosystem: Banks, Fintech Companies, and more |

|

Challenges and opportunities in the financial landscape |

||

|

What Is Fintech & Advantages? |

||

|

Traditional banking & finance Vs. Digital Banking and Fintech |

||

|

Digital India and its role in promoting FinTech |

||

|

Drivers of Fintech: Technology, Regulations and Digital models |

Digital Transformation in Banking & Finance Industry |

How Is Technology Transforming Banking & Finance Industry? |

|

Technology Types in Finance & Banking |

||

|

Digital business models |

||

|

Drivers of FinTech , Trends driving Fintech adoption |

||

|

FinTech Ecosystem and Emerging Sectors |

||

|

Fintech Statistics: India and Global |

||

|

Digital Payments |

For all three modules, the topic line-up would be

Regulations Regulatory arbitrage vs. regulatory risk |

|

|

Digital Lending |

||

|

Digital Insurance |

||

|

Data Strategy in Finance (By Industry Expert) |

Data Analysis - Big Data introduction, Application in Finance |

|

|

Cyber Security in Finance |

||

|

AI and Generative AI in Finance |

Introduction to AI, Generative AI and ML |

|

|

Use case 1: Lending Tech : Credit Risk Modeling |

||

|

Use case 2: Insurtech : Underwriting and fraud detection |

||

|

Use case 3: Wealth Tech: Robo Advisory and algorithmic Trading |

||

|

AI governance: Risks and Ethics |

||

|

Understanding Blockchain and applications |

Blockchain and its Key Concepts |

|

|

How it Works? |

||

|

Blockchain ecosystem |

||

|

Ethereum and Smart Contracts |

||

|

Cryptocurrency Stablecoins |

||

|

Initial Coin Offerings |

||

|

Blockchain applications: Wealth Management, Insurance, Payment etc |

||

|

Emerging technologies in Finance (By SME Proposed) |

Limitations of Blockchain |

|

|

Open banking and API integration |

||

|

Economy of API |

||

|

Building and Scaling APIs |

||

|

Cloud computing |

||

|

Robotic Process Automation |

||

|

Leading Innovation for a Sustainable and Inclusive Financial Future |

Sustainable Finance |

The need for sustainable business practices. |

|

Fintech and society |

||

|

Enabling green economic growth. |

||

|

Financial Inclusion and the Role of Technology |

||

|

Leadership in FinTech (fireside chat) |

Tech Giants in FinTech: Is It a Game Changer? |

|

|

Trends and Technologies Influencing Finance Industry: IoT, Metaverse etc. |

||

|

Capstone |

Capstone Project |

|

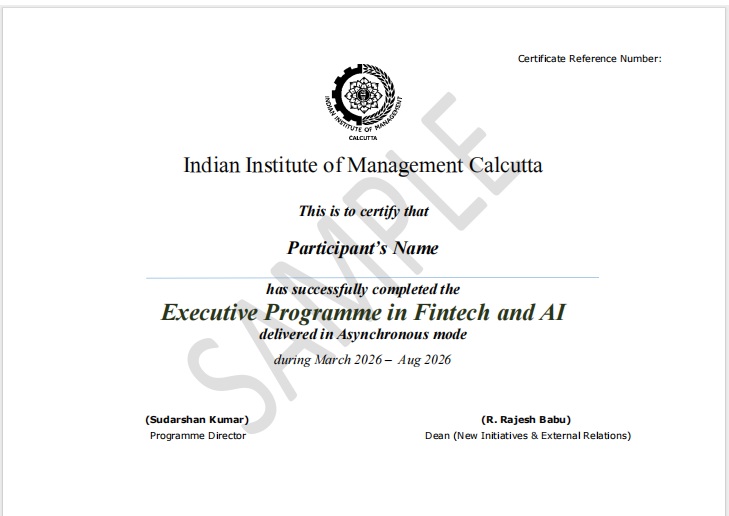

Programme Sample Certificate

How to Apply

Link -

Master FinTech & AI - Online Certification for Finance

Contact No: WhatsApp an Advisor on +918657038243*

Email ID: iimc.execed@emeritus.org

For registration and any other information, please get in touch with us at iimc.execed@emeritus.org

*This number does not accept any calls. Please message your queries.